The operating income calculated using variable costing and absorption costing amounted to $9800 and $11,000, respectively. There were no beginning inventories. Determine the total fixed manufacturing overhead that will be expensed under variable costing for the year 2016.

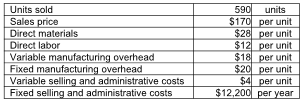

Yazzie, Inc. reports the following information for the year ended December 31:

A) $13,000

B) $11,800

C) $28,320

D) $34,220

A) $13,000

Number of units in the ending Fixed Goods Inventory = (Profit using absorption costing -

Profit using variable costing) / Fixed manufacturing overhead per unit =

($11,000 - $9800) / $20 per unit = 60 units

Number of units produced = Units sold + Ending Inventory - Beginning Inventory

Number of units produced = 590 units + 60 units - 0 = 650 units

Under variable costing, total fixed manufacturing overhead incurred during the period are expensed,

irrespective of the period in which the units are sold.

Therefore, total fixed manufacturing overhead expensed under variable costing =

650 units × $20 per unit = $13,000

You might also like to view...

An exogenous construct is represented in an structural path model as a box with one-headed arrows going into it

Indicate whether the statement is true or false

Which sentence uses correct capitalization?

A) Many snow enthusiasts travel to Salt Lake City to ski in the Rocky mountains. B) Many snow enthusiasts travel to Salt Lake City to ski in the Rocky Mountains. C) Many snow enthusiasts travel to Salt Lake city to ski in the Rocky mountains.

Which of the following would NOT be discharged in a bankruptcy?

A) a student loan taken out three years ago B) debt on a bank guarantee C) credit card debts under $10,000 D) bank loans E) loans from a non-arm's length party

When using the effective-interest amortization method, the amount of the interest payment is calculated using the face value of the bonds and the stated interest rate

Indicate whether the statement is true or false