The face value of a bond is

A) the dollar amount that a person would receive if he or she were to sell the bond.

B) the dollar amount that a person would receive if he or she were to buy the bond.

C) the total value of payments that will be made over the course of the bond's life.

D) the dollar amount of the bond's final payment at maturity.

D

You might also like to view...

Suppose that Congress allocates $5 billion to an "energy-efficient appliance rebate" program. It also raises taxes by $5 billion to keep the deficit from growing. If the marginal propensity to consume is 0.8, what is the effect on equilibrium GD

A) GDP does not change. B) GDP increases by $5 billion. C) GDP increases by $25 billion. D) GDP increases by $4 billion.

The markup pricing technique involves determining the selling price of a good by adding a profit markup to minimum average cost. This would result in maximum profits only if

a. average cost were constant. b. the markup were zero. c. the markup varied with the elasticity of demand. d. demand were inelastic.

When wages rise:

A. neither the opportunity cost of an hour of leisure nor the quantity of labor supplied is likely to change. B. the opportunity cost of an hour of leisure declines. C. the quantity of labor supplied always declines. D. the opportunity cost of an hour of leisure increases.

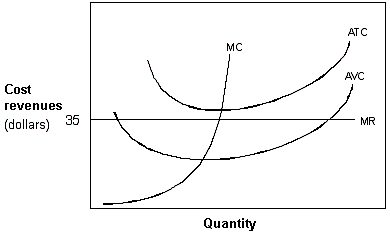

Exhibit 7-8 A firm's cost and marginal revenue curves

?

A. This firm should shut down. B. This firm could increase profits by increasing output. C. This firm could increase profits by decreasing output. D. This firm should continue to operate at its current output.