Suppose that, for every 1-percentage-point decline of the discount rate, commercial banks collectively borrow an additional $2 billion from Federal Reserve Banks. Also assume that the reserve ratio is 20 percent. If the Fed increases the discount rate

from 4.0 percent to 4.25 percent, bank reserves will:

A. increase by $0.5 billion and the money supply will increase by $2.5 billion.

B. decline by $0.5 billion and the money supply will decline by $2.5 billion.

C. increase by $0.75 billion and the money supply will increase by $3.75 billion.

D. increase by $1 billion and the money supply will increase by $5 billion.

B. decline by $0.5 billion and the money supply will decline by $2.5 billion.

You might also like to view...

Economic growth occurs as a result of all of the following EXCEPT

A) more labor hours. B) growth of capital. C) technological progress. D) less saving.

Perfect competition and monopolistic competition are similar in that firms in both types of market structure will.

A) act as price takers. B) produce a level of output where price equals marginal cost. C) earn zero profit in the long run. D) act as price setters.

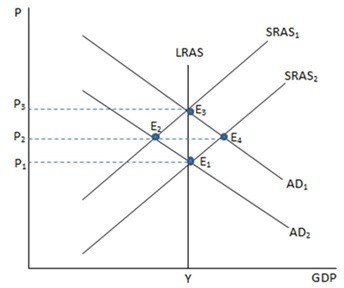

If the economy is experiencing an economic boom, which point in the graph shown would likely represent this?

If the economy is experiencing an economic boom, which point in the graph shown would likely represent this?

A. E1 B. E2 C. E3 D. E4

If monopolistically competitive firms earn short-run economic profits, we expect to see

A. new firms trying to enter the industry, but unable to do so because of barriers to entry. B. existing firms altering their scale of plant to try to capture larger profits. The combined effect is to cause all firms to earn zero economic profits. C. existing firms increasing prices to try to capture larger economic profits. D. new firms enter the industry, which shifts the demand curves of the existing firms to the left until firms earn zero economic profits.