In the 1979-82 period, the Fed pursued a monetary policy which targeted the growth rate of the money supply. Given the effects of financial deregulation on money demand you would expect, ceteris paribus,

A) stable interest rates.

B) volatile interest rates.

C) a constant interest rate.

D) slow growth in interest rates.

B

You might also like to view...

In the short-run, any rise in the real exchange rate, EP /P, will cause

A) an upward shift in the aggregate demand function and a reduction in output. B) an upward shift in the aggregate demand function and an expansion of output. C) a downward shift in the aggregate demand function and an expansion of output. D) an downward shift in the aggregate demand function and a reduction in output. E) an upward shift in the aggregate demand function but leaves output intact.

A bank's assets consist of $1,000,000 in total reserves, $2,100,000 in loans, and a building worth $1,200,000 . Its liabilities and capital consist of $3,000,000 in demand deposits and $1,300,000 in capital. If the required reserve ratio is 10 percent, what is the level of the bank's excess reserves? How much money could the excess reserves be used to create in the banking system as a result?

a. $700,000; $700,000 b. $700,000; $7,000,000 c. $300,000; $300,000 d. $300,000; $3,000,000

6%-8% economic growth rate is 2% what is nominal rate

What will be an ideal response?

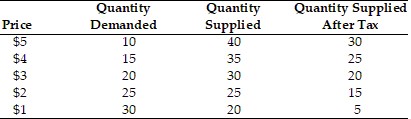

Using the above table, a unit tax of $2 is imposed on the product. How much of the tax is paid by the consumer?

Using the above table, a unit tax of $2 is imposed on the product. How much of the tax is paid by the consumer?

A. $2 B. $1 C. $3 D. unable to determine