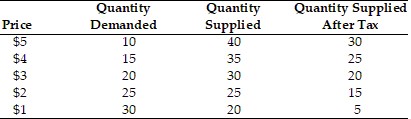

Using the above table, a unit tax of $2 is imposed on the product. How much of the tax is paid by the consumer?

Using the above table, a unit tax of $2 is imposed on the product. How much of the tax is paid by the consumer?

A. $2

B. $1

C. $3

D. unable to determine

Answer: B

You might also like to view...

If cable TV subscriptions and movie rentals are substitutes for each other, what is the effect in each of these markets of an increase in wages for people who work for the cable TV company? Use your analysis to determine the sign of the cross

elasticity of demand between the quantity of movie rentals and the price of cable TV.

A reliable indicator of a healthy economy is an appreciating currency

a. True b. False

In the short run if the tax rate on asset income rises, then in the market clearing model:

a. household current consumption will fall compared to future consumption. b. the after tax real interest rate rises. c. current investment will fall. d. all of the above.

Most of the Fed's income is:

A. paid to member banks in the form of a dividend. B. used to build the Fed's portfolio of securities. C. sent to the FDIC to shore up the depositor insurance fund. D. returned to the U.S. Treasury.