Which of the following should be considered when analyzing manufacturing overhead variances?

A) whether costs incurred are product costs or period costs

B) whether direct materials costs are higher than standard costs

C) whether certain manufacturing overhead costs are controllable

D) whether direct labor costs can be reduced

C

You might also like to view...

A cashier who purposely undercharges a customer or allows a friend to walk away without paying for items would most likely be accused of which of the following?

A) sweethearting B) experiential shopping C) retail borrowing D) off-price retailing E) customer profiling

The market leader normally gains the most when ________

A) its total market diminishes B) it achieves expanded market share C) its personal communication channels expand D) the niche marketing efforts by other firms expand E) the major global competitors enter the market

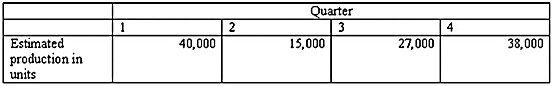

Morris Company makes one product, and it expects to incur a total of $600,000 in indirect (overhead) costs during the current year. Production of the product for the year is expected to be: Required:1) Calculate a predetermined overhead rate based on the number of units of product expected to be made during the current year.2) Assuming that direct materials and direct labor costs are $10 and $15, respectively, determine the total cost per unit using the overhead rate you calculated in part (1).

Required:1) Calculate a predetermined overhead rate based on the number of units of product expected to be made during the current year.2) Assuming that direct materials and direct labor costs are $10 and $15, respectively, determine the total cost per unit using the overhead rate you calculated in part (1).

What will be an ideal response?

An M/M/2 model has Poisson arrivals exponential service times and two channels

Indicate whether the statement is true or false