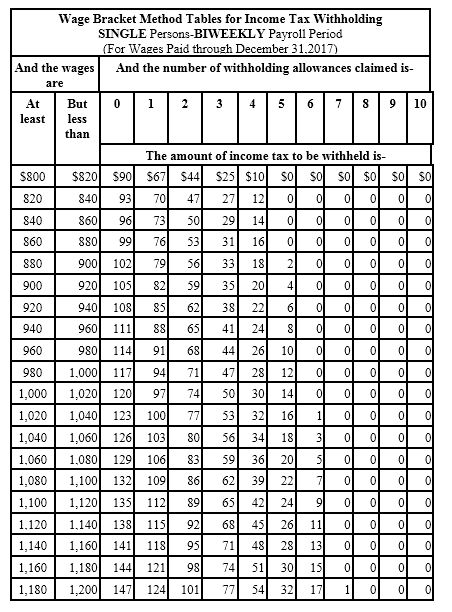

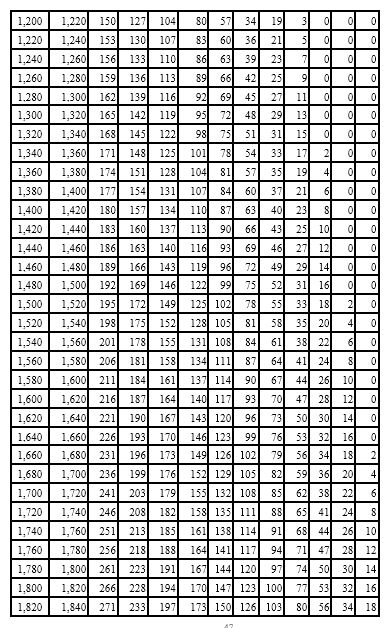

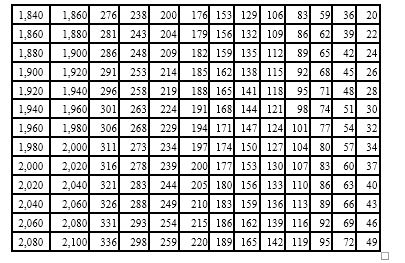

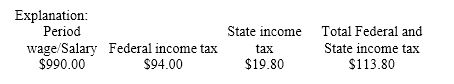

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period. She is single with 1 withholding allowance and both lives and works in Maryland. Assuming that she had no overtime, what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket tables. Maryland state income rate is 2.0%. Round final answer to 2 decimal places.)

A) $124.25

B) $113.80

C) $115.95

D) $110.78

B) $113.80

You might also like to view...

Reducing the complexity of a product and improving a product's maintainability are activities of:

A) product lifecycle management (PLM). B) product-by-value analysis. C) manufacturability and value engineering. D) organizing for product development. E) design for destruction (DFD).

Potential investments include all of the following instruments except

A) stocks and bonds. B) mutual funds. C) real estate. D) lottery tickets.

In the Coors case study, why was a genetic algorithm paired with neural networks in the prediction of beer flavors?

A) to replace the neural network in harder cases B) to complement the neural network by reducing the error term C) to enhance the neural network by pre-selecting output classes for the neural network D) to best model how the flavor of beer evolves as it ages

A compact disc read-only memory (CD-ROM), commonly referred to as a CD, is an optical medium that stores up to ____ MB of data.

A. 600 B. 700 C. 800 D. 900