Most markets in the United States:

A. are monopolies.

B. have some degree of competitiveness, but are not perfectly competitive.

C. are perfectly competitive.

D. have very few competitive features and so are regulated by the government.

Answer: B

You might also like to view...

Property taxes are a major source of revenue for

A) state and local governments. B) the federal governments. C) the federal, state, and local governments. D) firms wanting to relocate their operations. E) consumers.

A measure of how much debt an investor takes on in making an investment is referred to as

A) asset management. B) the debt-equity ratio. C) securitization. D) leverage.

Karl Marx published:

a. Das Kapital. b. General Theory of Communism. c. The Wealth of Nations. d. Capitalist Manifesto.

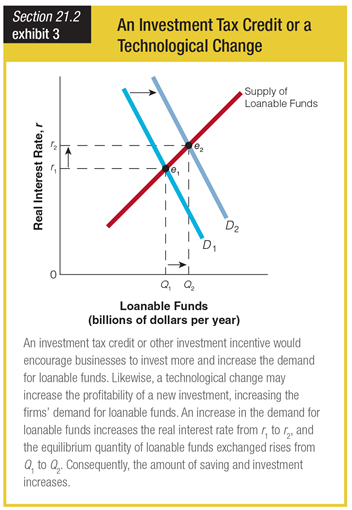

Based on the graph showing the effects of an investment tax credit or a technological change, enacting an investment tax credit would ______.

a. create a negative real interest rate

b. have little or no effect on the real interest rate

c. increase the real interest rate

d. decrease the real interest rate