The Department of Labor has conducted an investigation of home builders and found that those who are building homes for several of the nation's largest homebuilders are treated as independent contractors. That is, the builders do not pay wage taxes, unemployment taxes, or withhold Social Security or income tax payments from their paychecks. However, the builders dictate the hours of work, the

amount of work, and the location of the work as well as the time for their breaks.? Which of the following statements is correct??

A) ?The construction workers on the homes are independent contractors.

B) ?The construction workers on the homes are not agents of the builders.

C) ?The construction workers are, in effect, employees of the builders.

D) ?The construction workers are temporary help and the builders do not owe any wage taxes as a result.

C

You might also like to view...

The social network which focuses on career-minded professionals is ________

A) Facebook B) LinkedIn C) MySpace D) Twitter E) Gawker

In a short essay, describe the process of coding and discuss the purpose of a field and a record. Include a specific example to support your answer. Next, describe the purpose of a codebook in the coding process

What will be an ideal response?

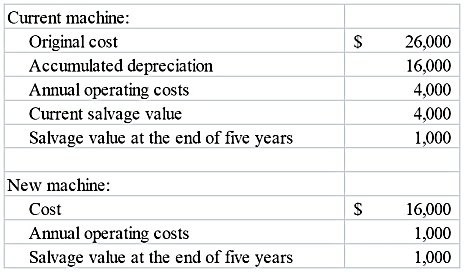

The Mendez Company is trying to decide whether to replace a packing machine that it uses to pack salsa into individual serving size packages. The following information is provided: Required:1) Compute the increase or decrease in total net income over the five-year period if the company chooses to buy the new machine.2) Compute the impact on the company's net income in the first year if the current machine is replaced. Do not take depreciation into account.

Required:1) Compute the increase or decrease in total net income over the five-year period if the company chooses to buy the new machine.2) Compute the impact on the company's net income in the first year if the current machine is replaced. Do not take depreciation into account.

What will be an ideal response?

In an independent vertical marketing system, manufacturers seek out wholesalers, who seek out retailers to stock and sell products

Indicate whether the statement is true or false