Jeb separated people who wanted a high-quality car from people who wanted a low-priced car, then saw whether different characteristics were associated with each consumer-response segment. Jeb was defining segments using ______________________ considerations.

A.descriptive

B.demographic

C.psychographic

D.behavioral

E.geographic

Answer: D.behavioral

You might also like to view...

Buyers may relate price to quality. To such a buyer, a higher price for a product is an indicator of

A. suspicious pricing. B. higher quality. C. product availability. D. poor image. E. greater quantity.

Total equity is $1,620, fixed assets are $1,810, long-term debt is $650, and short-term debt is $300. What is the amount of current assets?

A) $760 B) $360 C) $1,140 D) $480 E) $790

Prepare Plax's Consolidated Statement of Financial Position as at December 31, 2018.

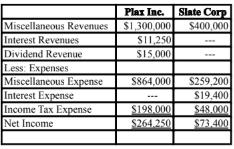

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the

straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

What will be an ideal response?

A broker takes bushels of corn from a farmer in the amount of $10 per bushel as commission. Several days later, the broker sold the corn for a profit. The broker's action constitutes:

A. a secret profit. B. profiting at the expense of the principal. C. a legal profit D. a breach of the agency relationship unless the $5 per bushel profit is disclosed to the farmer.