Among all countries in the world, the United States has the most income inequality

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

The substitution effect shows that when the wage rate increases

a. an additional hour of labor is not worth pursuing. b. an additional hour of leisure is now less costly in terms of foregone consumption. c. an additional hour of leisure is now more expensive in terms of foregone consumption. d. there will be intertemporal substitution.

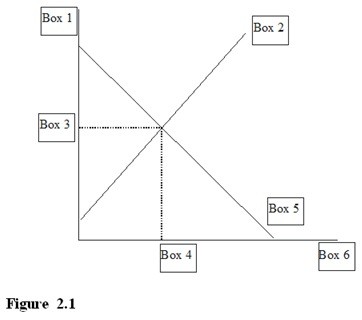

In Figure 2.1, a "D" for Demand would go in

A. Box 4. B. Box 5. C. Box 6. D. Box 2.

If policymakers use a pollution tax to control pollution, the tax per unit of pollution should be set

A) equal to the marginal external cost at the economically efficient level of pollution. B) equal to the marginal private cost of production at the economically efficient level of pollution. C) equal to the amount of the deadweight loss created in the absence of a pollution tax. D) at a level low enough so that producers can pass along a portion of the additional cost onto consumers without significantly reducing demand for the product.

The primary economic advantage of the European Union (EU) to its members is that:

A. the tax structures of each participating nation have been made nearly identical. B. each nation is free to formulate its own antitrust and agricultural policies. C. participating nations must all use a common currency. D. the reduction of trade barriers permits producers to achieve mass-production economies.