Grande Corporation assembles bicycles by purchasing frames, wheels, and other parts from various suppliers. Consider the following data: *The company plans to sell 25,000 bicycles during each month of the year's first quarter.*A review of the accounting records disclosed a finished-goods inventory of 1,400 bicycles on January 1 and an expected finished-goods inventory of 1,850 bicycles on January 31.*Grande has 4,300 wheels in inventory on January 1, a level that is expected to drop by 5% at month-end.*Assembly time totals 30 minutes per bicycle, and workers are paid $14 per hour.*Grande accounts for employee benefits as a component of direct labor cost. Pension and insurance costs average $2 per hour (total); additionally, the company pays Social Security taxes that amount to 8% of

gross wages earned.Required: A. How many bicycles does Grande expect to produce (i.e., assemble) in January?B. How many wheels are budgeted to be purchased in January?C. Compute Grande's total direct labor cost for January.D. Briefly explain how the company's purchasing activity would affect the end-of-period balance sheet.

What will be an ideal response?

A. Finished-goods inventory is expected to increase by 450 units (1,850 - 1,400). Thus, the company will assemble 25,450 bicycles (25,000 + 450).

B. Grande's production will require 50,900 wheels (25,450 × 2). Given that inventory will drop by 215 units (4,300 × 5%), the company must purchase 50,685 wheels (50,900 - 215).

C. Assembly time: 25,450 bicycles × 30/60 = 12,725 hours

| Labor cost: | ? |

| Wages: 12,725 hours x $14 | $178,150 |

| Pension and insurance: 12,725 hours × $2 | 25,450 |

| Social Security taxes: $178,150 × 8% | 14,252 |

| Total | $217,852 |

D. Purchasing activity would likely affect the balance sheet in several ways. Grande's Cash account would decrease and any end-of-period obligations to suppliers would be disclosed as accounts payable. In addition, the wheels on hand at the end of the period would affect raw-material inventories, and the cost of wheels acquired and used would influence the ending inventory of bicycles.

You might also like to view...

Which of the following organizations is responsible for setting auditing standards followed by public accounting firms in conducting independent audits of financial statements?

a. Financial Accounting Standards Board (FASB) b. Securities and Exchange Commission (SEC) c. Public Company Accounting Oversight Board (PCAOB) d. International Accounting Standards Board (IASB)

A withholding allowance is an amount on which no federal income tax is withheld from the employee's pay

Indicate whether the statement is true or false

According to the text, total measurement error is determined by multiplying systematic error with random error

Indicate whether the statement is true or false

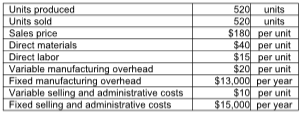

What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent.)

Yancey, Inc. reports the following information:

A) $40.00

B) $80.00

C) $125.00

D) $100.00