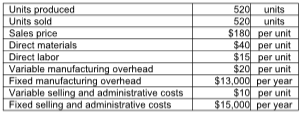

What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent.)

Yancey, Inc. reports the following information:

A) $40.00

B) $80.00

C) $125.00

D) $100.00

D) $100.00

Total unit product cost:

Direct materials $40

Direct labor 15

Variable manufacturing overhead 20

Fixed manufacturing overhead ($13,000 / 520 units) 25.00

Total unit product cost $100.00

You might also like to view...

Based on a report issued by American Express and Millennial Branding, which of the following is often cited by managers as a negative trait attribute of young workers?

A) Strong interpersonal interactions B) Soft skills regarding communication C) Excessive self confidence D) Willingness to work as a team E) Ability to multitask

Answer the following statements true (T) or false (F)

1. When a unionized company decides to relocate its operations to a nonunion site as a way of dealing with competitive pressures, it is called an "escape" strategy. 2. A forcing strategy is one in which the union and employees are pressured to accept the changes management wishes to implement in response to competitive pressures. 3. When management seeks to create a cooperative labor-management relationship in response to competitive pressures, it is known as a "co-opting strategy." 4. A formal initiative in which workers and union leaders are full business partners in organizational decision making is called a "social partnership" or "social compact." 5. Labor-management partnerships have been shown to be effective in creating better labor-management relations, reducing workplace disputes, and improving performance.

“ …the whole process in which leader emotional displays influence subordinates’ moods and thus their performance, and includes the leader’s use of surface acting, deep acting, and genuine emotional expression, as well as their effects on the subordinates’ moods and performance” defines

a. impression management b. leading with emotional labor c. rhetorical skills d. narcissism

Karl, an employee of Smith Electric, Inc, has gross salary for March of $4,000

The entire amount is under the OASDI limit of $117,000 and thus subject to FICA. He is also subject to federal income tax at a rate of 18%. Karl has a deduction of $320 for health insurance and $80 for United Way. Provide the journal entry to record salaries expense and payroll withholdings. (Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%.) What will be an ideal response