Explain the impact of supplier lead time on safety inventory

What will be an ideal response?

Answer: The required safety inventory increases with an increase in the lead time and the standard deviation of periodic demand. Reducing the supplier lead time (L) will reduce the need for safety inventory. If lead time decreases by a factor of k, the required safety inventory decreases by a factor of k. The only caveat here is that reducing the supplier lead time requires significant effort from the supplier, while reduction in safety inventory occurs at the retailer. Thus it is important for the retailer to share some of the resulting benefits. A reduction in supply uncertainty can help dramatically reduce safety inventory required without hurting product availability.

Often, safety inventory calculations in practice do not include any measure of supply uncertainty, resulting in levels that may be lower than required. This hurts product availability.

You might also like to view...

NAFTA includes a side agreement known as _______________________________ that seeks to protect workers by promoting union representation, nondiscrimination, equal pay, minimum wages, and workplace safety.

Fill in the blank(s) with the appropriate word(s).

Generally, a misrepresentation of law is actionable

Indicate whether the statement is true or false

Narrative 11-1 Solve the following problems using either Tables 11-1 or 11-2 from your text. When necessary, create new table factors. (Round new table factors to five decimal places, round dollars to the nearest cent and percents to the nearest hundredth of a percent) Refer to Narrative 11-1. Laura wants to have $6,500 in 8 years. Calculate how much she should invest now at 8% interest,

compounded quarterly in order to reach this goal. A) $3,534.18 B) $4,448.81 C) $3,449.16 D) $2,120.00

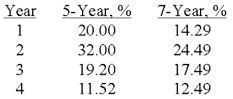

On July 1, Year 1, Glover Corporation purchased $80,000 of equipment. The equipment is expected to be used in the business for five years and has an estimated salvage value of $11,000. Partial MACRS tables are listed below: Required: a) Compute the amount of depreciation that is deductible under MACRS for Year 1 and Year 2 assuming that the equipment is classified as 5-year property.b) Compute the amount of depreciation that is deductible under MACRS for Year 1 and Year 2 assuming that the equipment is classified as 7-year property.

Required: a) Compute the amount of depreciation that is deductible under MACRS for Year 1 and Year 2 assuming that the equipment is classified as 5-year property.b) Compute the amount of depreciation that is deductible under MACRS for Year 1 and Year 2 assuming that the equipment is classified as 7-year property.

What will be an ideal response?