Meinke Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During April, the kennel budgeted for 3,700 tenant-days, but its actual level of activity was 3,680 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for April:Data used in budgeting: Fixed element per monthVariable element per tenant-dayRevenue - $33.80 Wages and salaries$3,100 $6.40Food and supplies 1,000 14.40Facility expenses 9,100 3.40Administrative expenses 6,500 0.40Total expenses$19,700 $24.60?Actual results for April: ?Revenue$118,524 Wages and salaries$27,122?Food and supplies$51,982?Facility expenses$20,852?Administrative

expenses$8,052???The administrative expenses in the planning budget for April would be closest to:

A. $7,972

B. $8,096

C. $8,052

D. $7,980

Answer: D

You might also like to view...

Which of the following strategies should be used to effectively help customers with hearing disabilities?

A. Ensure you over exaggerate your mouth's movements so that the customer can see your mouth form words. B. Use facial expressions and gestures to emphasize key words or express thoughts. C. Avoid speaking louder or reducing background noise as it might hurt the customer's feelings. D. Interact with the customers by asking them closed-end questions for which the customer must provide descriptive answers.

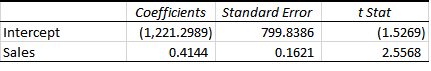

Consider the regression results where sales is the independent variable and cash is the dependent variable. If next year’s sales are forecasted to be 8,260, what is the forecast for cash?

a) $3,953.95

b) $4,054.37

c) $2,201.57

d) $1,221.30

e) $799.84

Which of the following statements is TRUE of process costing?

A) It uses one Work-in-Process Inventory account. B) It tracks and assigns both period costs and product costs to units produced. C) It accumulates product costs by production departments. D) It assigns manufacturing overhead costs to products only in the last production process.

The gross margin does not take into account:

A. nonmanufacturing cost. B. manufacturing overhead. C. direct materials and direct labor. D. sales price.