Why does the substitution bias cause the consumer price index to overstate inflation and the cost of living? Why does the increase in quality bias cause the consumer price index to overstate inflation and the cost of living?

What will be an ideal response?

The substitution bias causes the CPI to overstate inflation and the cost of living because the CPI, being based on a fixed market basket of goods and services, implicitly assumes that consumers do not switch away from products whose prices are rising and into products whose prices are falling (or rising less). Consumers dodge some price increases by switching to other products, therefore decreasing their cost of living below what the CPI indicates.

The increase in quality bias causes the CPI to overstate inflation and the cost of living because a portion of the price increase of many goods and services is due to an increase in quality. The Bureau of Labor Statistics tries to filter out the portion of the price increase due to quality, but does not fully adjust the price increase for quality improvements.

You might also like to view...

The reason the marginal cost curve eventually increases as output increases for the typical firm is because of

A. diseconomies of scale. B. increasing opportunity cost. C. diminishing marginal returns. D. diminishing marginal utility.

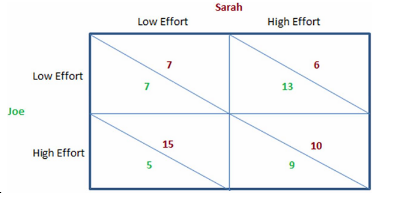

According to the figure shown, Sarah:

This figure shows the payoffs involved when Sarah and Joe work on a school project together for a single grade. They both will enjoy a higher grade when more effort is put into the project, but they also get pleasure from goofing off and not working on the project. The payoffs can be thought of as the utility each would get from the effort they individually put forth and the grade they jointly receive.

A. should put forth low effort, regardless of what Joe chooses to do.

B. should put forth high effort, regardless of what Joe choose to do.

C. does not have a dominant strategy.

D. should take the first-mover advantage and put forth low effort.

The required reserve ratio is required reserves stated as a percentage of the money supply

a. True b. False Indicate whether the statement is true or false

The flypaper theory of tax incidence

a. ignores the indirect effects of taxes. b. assumes that most taxes should be "stuck on " the rich. c. says that once a tax has been imposed, there is little chance of it changing, so in essence people are stuck with it. d. suggests that taxes are like flies because they are everywhere and will never go away.