Deposit insurance is:

A. a Federal Reserve Bank regulation that covered deposits by individuals against losses.

B. private insurance by depositors to guarantee against a bank run that would affect deposits.

C. a regulation that limits how much an individual can deposit at a single bank to avoid bank runs.

D. government insurance that promised to reimburse individuals for loss in the value of deposits.

Answer: D

You might also like to view...

Appreciation of the Japanese yen would lead to

A. outward shift in the aggregate supply curve for Japan. B. upward shift in the aggregate demand curve for Japan. C. downward shift in the aggregate supply curve for Japan. D. downward shift in the aggregate demand curve for Japan.

Profits represent

A) a reward to entrepreneurs. B) the income earned from a bond. C) the difference between total tax revenue and total government spending. D) the payments firms make to their employees.

Using the cash balance version of the quantity theory with k = .2, an increase in the money supply of $100 billion leads to an increase in GDP of

A) $500 billion. B) $100 billion. C) $50 billion. D) $20 billion.

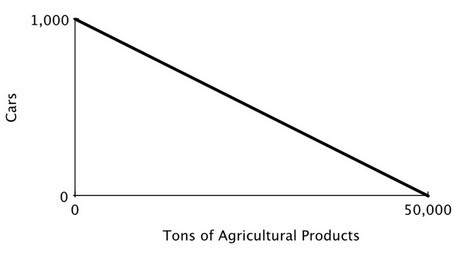

The accompanying figure shows the production possibilities curve for the island of Genovia: The opportunity cost of producing a car in Genovia is:

The opportunity cost of producing a car in Genovia is:

A. 5 tons of agricultural products. B. 500 tons of agricultural products. C. 50 tons of agricultural products. D. 5,000 tons of agricultural products.