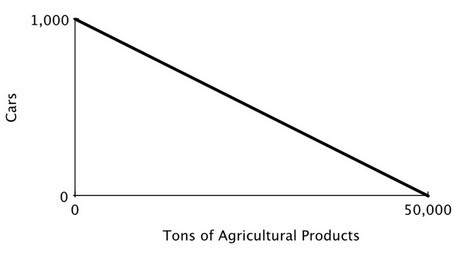

The accompanying figure shows the production possibilities curve for the island of Genovia: The opportunity cost of producing a car in Genovia is:

The opportunity cost of producing a car in Genovia is:

A. 5 tons of agricultural products.

B. 500 tons of agricultural products.

C. 50 tons of agricultural products.

D. 5,000 tons of agricultural products.

Answer: C

You might also like to view...

There are several assumptions that are the basis of the operation of the benchmark competitive labor market. Which of the following is not one of these assumptions?

A. Wage rates are costlessly observable. B. Compensation is made up of wages and benefits. C. There are no long-term contracts. D. All jobs are identical.

Falling output, in the short run, could be due to:

A. an increase in short-run aggregate supply. B. a reduction in aggregate demand. C. an increase in long-run aggregate supply. D. an increase in aggregate demand.

If the Fed decides to buy T-bills, it increases the demand for T-bills. How will this affect the price of T-bills and the interest rate?

A. T-bill prices fall and interest rates fall. B. T-bill prices rise and interest rates rise. C. T-bill prices rise and interest rates fall. D. T-bill prices fall and interest rates rise.

As financial intermediaries, how do commercial banks pay their expenses and earn profit?

a. Banks pay depositors a higher interest rate than they charge borrowers b. Banks pay depositors a lower interest rate than they charge borrowers. c. Banks earn interest from their deposits at the Federal Reserve. d. Banks invest funds from stockholders in the stock and bond markets.