Suppose the demand curve for a good is highly elastic and the supply curve is highly inelastic. If the government taxes this good,

a. buyers and sellers will each share 50 percent of the burden, regardless of the elasticities of the demand and supply curves.

b. sellers will bear a larger share of the tax burden.

c. the distribution of the burden will depend upon whether the buyers or the sellers are required to send the tax to the government.

d. buyers will bear a larger share of the tax burden.

B

You might also like to view...

The quantity theory of money predicts that, in the long run, inflation results from the

A) money supply growing at a faster rate than real GDP. B) velocity of money growing at a faster rate than real GDP. C) velocity of money growing at a lower rate than real GDP. D) money supply growing at a lower rate than real GDP.

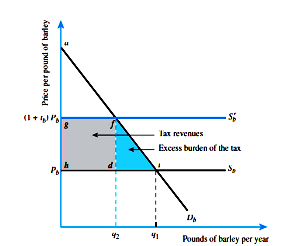

Refer to the figure below. Suppose that the demand curve for barley can be characterized by the equation P = 100 - 2Q d . Suppose further that price was $10.00 and a $10.00 tax is imposed on the market.

(A) How many barleys would be purchased at a price of $10.00? After tax?

(B) What is the amount of tax revenue generated by the tax?

(C) How much excess burden is generated by the tax?

(D) What is the amount of consumer surplus before and after the tax? What is the difference in

consumer surplus? Is it equal to excess burden plus the tax revenue?

Over the past 70 years in the United States, employment in service-producing industries had increased significantly and employment in goods-producing industries has declined significantly. Economists would refer to this process as

A) the classical dichotomy. B) production parity. C) demographic imbalance. D) sectoral shifts.

Bridge Coal Company is the only employer in a remote and mountainous region of the country, so the firm is the monopsony buyer of labor in the market. If the price of coal increases, then the firm's:

A) ME curve shifts leftward. B) AE curve shifts rightward. C) ME and AE curves shift rightward. D) MV curve shifts rightward.