Solve the problem.

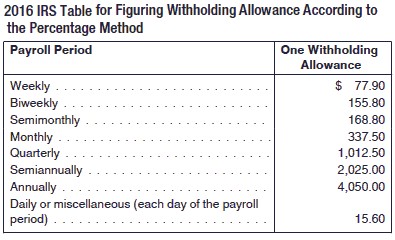

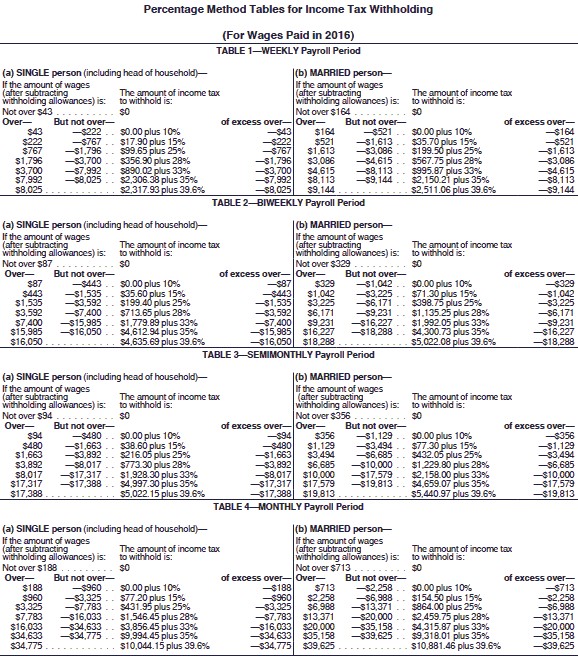

Kevin Mondale earns a monthly salary of $23,612.15. He has a $300 adjustment-to-income flexible benefits package, is married, and claims 5 withholding allowances. Find the federal tax withholding to be deducted from his monthly paycheck using the percentage method tables.

Kevin Mondale earns a monthly salary of $23,612.15. He has a $300 adjustment-to-income flexible benefits package, is married, and claims 5 withholding allowances. Find the federal tax withholding to be deducted from his monthly paycheck using the percentage method tables.

A. $11,452.00

B. $5408.88

C. $4852

D. $4951.00

Answer: C

You might also like to view...

Solve the problem.The population in a particular country is growing at the rate of 2.6% per year. If 2,546,000 people lived there in 1999, how many will there be in the year 2006? Round to the nearest ten-thousand.

A. 3,050,000 people B. 3,670,000 people C. 3,360,000 people D. 2,990,000 people

Simplify. Assume that variables can represent any real number.

A. 7t

B. 24

C. 7

D. 7t2

Write as a percent. Round the percent to the nearest tenth if necessary.

A. 800% B. 8% C. 0.8% D. 80%

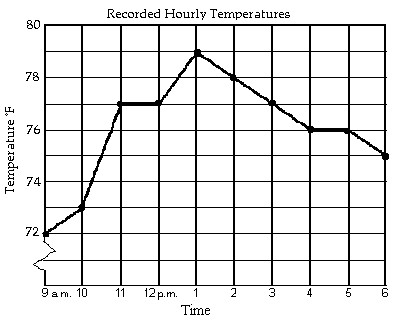

The line graph shows the recorded hourly temperatures in degrees Fahrenheit at an airport.  During which hour did the temperature increase the most?

During which hour did the temperature increase the most?

A. 1 p.m. to 2 p.m. B. 9 a.m. to 10 a.m. C. 10 a.m. to 11 a.m. D. 12 p.m. to 1 p.m.