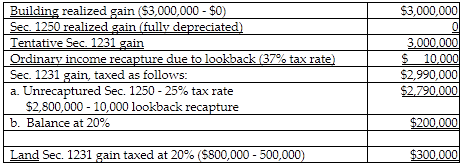

She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

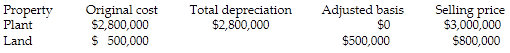

Julie sells her manufacturing plant and land originally purchased in 1980. Accelerated depreciation had been taken on the building, but the building is now fully depreciated. Julie is in the 37% marginal tax bracket. Other information is as follows:

You might also like to view...

Which of the following items does not represent a UML class diagram object and its resulting database object?

A. Attributes ? Fields. B. Classes ? Tables. C. Associations ? Relationships. D. Multiplicities ? Records.

Which option for the treatment of missing values involves the researcher using the respondents' pattern of responses to calculate a suitable response to the missing questions?

A) returning to the field B) casewise deletion C) substitute an imputed response D) substitute a neutral value

Camilla is the chief human resource officer at her company and is in charge of ethics training for all employees. Her department lacks the funding for extensive seminars and trainers, and most middle managers are not receptive to giving up their employees’ time for ethics training. What is the best possible strategy for her in administering proper ethics training?

a. Reduce the amount of ethics training--and reviews--to once every six months. b. Invest in web-based ethics training for the company. c. Provide a printed packet of ethics guidelines and best practices to each employee. d. Delegate ethics training to the managers of various departments to be implemented at their discretion.

Social responsibility is the idea that organizations are only accountable to stockholders.

Answer the following statement true (T) or false (F)