Assume a firm is a monopoly and enjoys $10 million in profits per year. The firm lobbies to have a moratorium passed by Congress on new firms in its market for the next 25 years

If there is no discount rate, how much would the firm be willing to pay to deter entry? A) $250 million

B) $25 million

C) $100 million

D) $250 billion

A

You might also like to view...

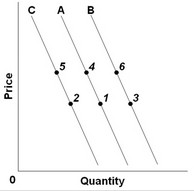

Use the figure below to answer the following question. In the past few years, the quantity of donuts demanded has increased due to changes in the prices of donuts. This would be illustrated by a change from

In the past few years, the quantity of donuts demanded has increased due to changes in the prices of donuts. This would be illustrated by a change from

A. point 5 to point 2. B. point 1 to point 2. C. point 3 to point 6. D. point 4 to point 6.

Which of the following is a discretionary fiscal policy action?

A) a progressive tax system that leads to an increase in income tax revenues during an economic boom B) a deliberate tax cut when the economy experiences high unemployment C) an increase in the amount of unemployment compensation because more people become unemployed D) an increase in Supplemental Security Income payments when more people become eligible for the benefits

How does marginal cost change as output increases (a) initially and (b) eventually?

What will be an ideal response?

During 2003, the Federal Reserve began to openly discuss deflation. Their comments suggested they

A. knew it was something to watch because of the Japanese experience of the 1990s, but did not alter policy significantly to combat it. B. were neutral about whether deflation would be a good thing. C. were enthusiastic about the possibility. D. knew it would be a disaster, so they immediately cut the target federal funds rate by 5 percentage points to avoid the possibility.