With voluntary exchange,

a. both the buyer and seller will be made better off.

b. the buyer will be made better off, while the seller will be made worse off.

c. the seller will be made better off, while the buyer will be made worse off.

d. both the buyer and the seller will be made worse off.

A

You might also like to view...

The solvency of Social Security can be extended if

A. the tax rate is reduced. B. the retirement age is increased. C. the cap on taxable earnings is lowered. D. the trust fund invests in government bonds.

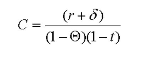

Assume that the user cost of capital (C) is simply

where r is the after tax rate of return, ? is the depreciation rate, ? is the corporate tax rate and,

r is the individual tax rate. Now assume further that the after-tax rate of return is 10 percent

and the economic depreciation rate is 2 percent. The firm faces corporate taxes of 35 percent

with an individual tax rate of 25 percent. Suppose that we now know that the present value of

depreciation allowances is 0.20. In addition, there is an investment tax credit of 0.10. What

effect does this new information have on the user cost of capital?

Price is the best predictor of an event

Indicate whether the statement is true or false

Economists believe that entrepreneurs, whether they can articulate their behavior or not, always think about ________, which explains their MC = MR profit-maximizing activity

a. minimizing ATC b. maximizing revenue c. the consequences of producing the next unit d. maximizing output e. doing better than breaking even