In the short run, a perfectly competitive firm suffering a loss

a. will close if P < AVC

b. will shut down operations if P < MC

c. cannot leave the industry even if P < AVC

d. can sell off all its resources to competitors

e. can raise the price to increase revenues

A

You might also like to view...

Refer to Figure 11.2. Assume the economy is in equilibrium at 1, where real GDP equals potential GDP

The economy experiences a negative demand shock, and the Fed responds by decreasing real interest rates to bring real GDP and inflation back to their original levels. Other things equal, the Fed's response to the negative demand shock is best represented by a movement from A) point B to point D. B) point C to point D. C) point B to point A. D) point C to point A.

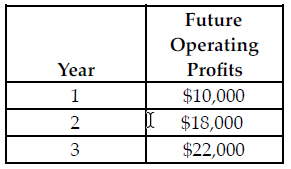

Refer to the table below. If the discount rate is 5 percent and the cost of the investment is $42,000, what is the net present value of the investment?

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of each of the respective years.

A) $44,854.77

B) $2,854.77

C) $3,599.22

D) $42,464.22

If the United States looks more economically and politically stable relative to the rest of the world, this will

A) decrease the demand for dollars. B) increase the demand for dollars. C) have no effect on the demand for dollars. D) stop all trading between the currencies of the United States and other countries.

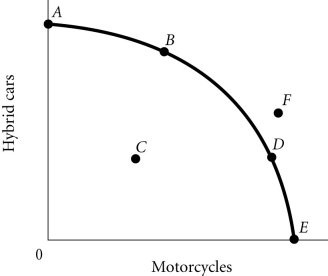

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point E necessarily represents

Figure 2.4According to Figure 2.4, Point E necessarily represents

A. only motorcycles being produced. B. overallocation of resources. C. an impossible production point. D. technological advancement.