Social insurance programs are designed to provide financial assistance to people who have fallen into poverty

Indicate whether the statement is true or false

F

You might also like to view...

When housing prices decrease, household wealth ________ and consumption ________.

A. increases; decreases B. increases; increases C. decreases; increases D. decreases; decreases

Currently. the price of consuming housing src="https://sciemce.com/media/3/ppg__cognero__Chapter_07_Income_and_Substitution_Effects_in_Consumer_Goods_Markets__media__9b711c52-06c1-4848-984d-2ca85addf439.PNG" style="vertical-align: -8px;" width="17px" height="28px" align="absmiddle" />. At the same time, the government lowers the tax on other consumption, lowering the price from

a. Write down your original budget constraint assuming the consumer has income I.

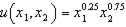

b. Suppose the utility function

c. How much housing and other goods will this consumer consume prior to any policy change?

d. How much would this consumer be willing to pay to get the policy change implemented?

What will be an ideal response?

The classical model predicts that, in the short-run, a tax cut financed by an increase in the money supply would

a. leave output and the price level unchanged. b. increase the price level but leave output unchanged. c. increase output but and reduce the price level. d. increase output and the price level by increasing aggregate demand. e. None of the above.

Which of the following is NOT a determinant of the price elasticity of demand?

A) the availability of potential substitutes B) the share of the budget spent on the item C) the time the consumer has to adjust to the price change D) the cost to produce the product