Market equilibrium is:

a. defined as the condition in which there is neither a shortage or surplus

b. defined as the condition under which the separately formulated plans of buyers and sellers exactly mesh when tested in the market.

c. represented graphically by the intersection of the supply and demand curves.

d. all of the above.

d

You might also like to view...

If a natural monopolist were to sell at the price where marginal cost equals demand, then it would be earning

a. zero economic profits, like a competitive firm in the long-run. b. negative profits and would not be able to survive. c. positive profits but not would not need to worry about government intervention to regulate it. d. positive profits but would still need to worry about possible government intervention to regulate it.

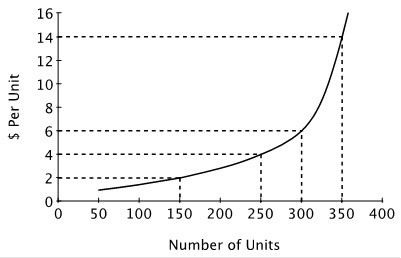

For a single seller, the figure below shows the relationship between the number of units produced and the opportunity cost of producing an additional unit of output. If the market consists of 50 identical sellers, how much would be supplied in the market at a price of $14 per unit?

A. 17,500 B. 350 C. 175,000 D. 1,750

The measures of absolute poverty:

a. are inversely related to the degree of income equality in a country. b. are directly related to the degree of income equality in a country. c. depend on the prosperity of the poorest 50 percent of population. d. determine the degree of income inequality. e. are completely independent of the degree of income inequality.

Based on the information in the table, what quantity of reserves would the Federal Reserve have had to inject into the economy in 1932 to prevent the money supply from falling, given that the public increased the amount of currency it held and that banks increased the reserve-deposit ratio? Currency held by public(in billions)Reserve-deposit ratioBank reserves (in billions)Money supply (in billions)December 1931$4.590.095$3.11$37.3December 1932$4.820.109$3.18$34.0

A. $0.30 billion B. $0.66 billion C. $3.54 billion D. $0.89 billion