What is the significance of the SEC's move toward accommodating International Financial Reporting Standards?

What will be an ideal response?

Answer: By moving toward this international accounting standard, the SEC is moving the United States and, in fact, the world toward one set of international standards, which will make it easier for investors to compare companies in different countries and also make it easier for companies in all countries to potentially report higher earnings.

Explanation: By moving toward this international accounting standard, the SEC is moving the United States and, in fact, the world toward one set of international standards, which will make it easier for investors to compare companies in different countries and also make it easier for companies in all countries to potentially report higher earnings.

You might also like to view...

In terms of the basic communication model:

A. the sales presentation contains the message. B. the customer is the source. C. there is no noise. D. the medium is either verbal or nonverbal, but not both. E. the trial close is the feedback.

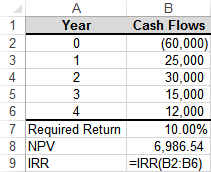

The Internal rate of Return (IRR) in cell B9 will be ___________ the Required Return in B7.

a) less than

b) equal to

c) greater than

d) Could be any of the above

e) None of the above

C-Swiss, a Swedish firm specializing in communication networks, reported a balance in Inventories of SEK21,500 million at the beginning of 2013 and SEK22,500 million at the end of 2013 . During 2013, C-Swiss reported SEK114,100 million in Cost of Sales. How much was C-Swisss' inventory purchases during 2013? [Assume that all of C-Swisss' inventory purchases are made on account and C-Swiss applies

IFRS, as well as reports its results in millions of Swedish kronor (SEK).] a. SEK115,300 million b. SEK115,200 million c. SEK115,100 million d. SEK113,100 million e. none of the above

Giles Inc Giles Inc manufactures high quality golfing equipment. Giles assigns overhead to products based on machine hours. At the beginning of the current year, estimated overhead costs were $500,000 and estimated machine hours were 50,000. During the year, 54,000 machine hours were actually used. By the end of the year, actual overhead costs were calculated to be $529,200. Refer to the Giles

Inc information above. By how much was overhead over- or underapplied for the year? A) $39,200 underapplied B) $29,200 underapplied C) $10,800 overapplied D) $42,336 overapplied