Taxable income" is

A. total income less deductions and exemptions.

B. earned income less property income.

C. all income other than wages and salaries.

D. wage and salary income only.

A. total income less deductions and exemptions.

You might also like to view...

If product Y is an inferior good, a decrease in consumer incomes will

A. shift the demand curve for product Y to the left. B. make buyers want to buy less of product Y. C. shift the demand curve for product Y to the right. D. not affect the sales of product Y.

Why would the market economy produce too little education?

What will be an ideal response?

In the long run, changing technology on average has led to: a. lower employment and lower wage rates

b. higher employment and lower wage rates. c. lower employment with wage rates unchanged. d. higher employment with wage rates unchanged. e. higher incomes and more leisure time.

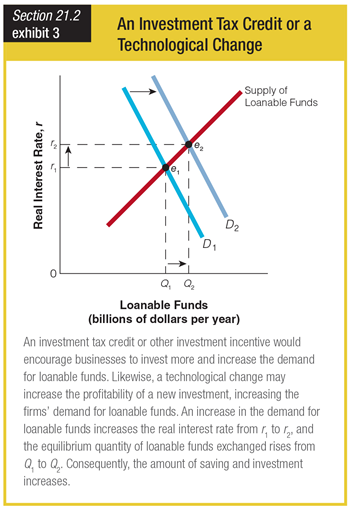

Based on the graph showing the effects of an investment tax credit or a technological change, eliminating an investment tax credit would ______.

a. increase the demand curve for loanable funds

b. decrease the demand curve for loanable funds

c. increase the supply curve for loanable funds

d. decrease the supply curve for loanable funds