Define what a matrix transpose is

What will be an ideal response?

a matrix's rows and columns are interchanged

You might also like to view...

Hill has a fiscal year-end of December 31. In February, Hill purchased a piece of equipment for $12,000 with a four-year useful life and a zero residual value. Hill used the equipment to produce finished goods in March that were sold on credit in April with cash collected in May. Hill uses straight-line depreciation. The amount of depreciation expense affecting the reported income on the first

quarter income statement was A) $250 B) $0 C) $500 D) $700

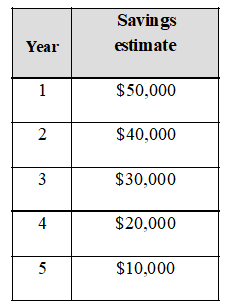

Zebra micro-devices, Inc. is considering an investment in new equipment that will cost $120,000 and is estimated to provide the following annual savings over its 5-year life:

a) Should the company acquire the new equipment if it can earn a return of 12% on its investments?

b) Should the company acquire the new equipment if it can earn a return of 9% on its investments?

c) Use the principal of value additivity to calculate the present value of the savings.

d) What is the implied annual rate of return is associated with the new equipment?

If an adjusting entry for accrued wages was recorded on December 31, and reversing entries are recorded by the business, then the reversing entry on January 1 would debit the Wages Payable account and credit the Wages Expense account

Indicate whether the statement is true or false

The successful implementation of a new strategic goal includes a target, a team, a project plan, and ________________.

a. rewards and consequences b. a financial incentive c. a leader d. low expectations