Supply-side economists favor tax incentives that

A. Discourage infrastructure development.

B. Encourage investment.

C. Discourage saving and encourage spending.

D. Increase the level of government regulation.

Answer: B

You might also like to view...

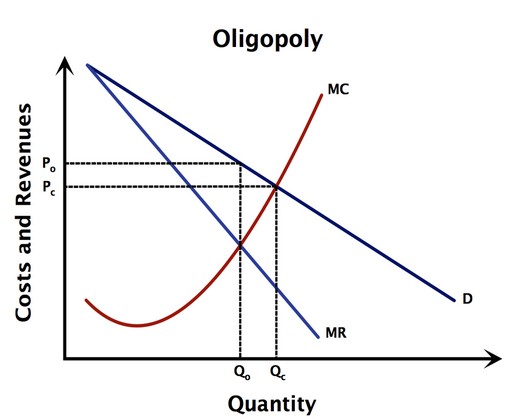

Use the following graph to answer the next question: If the firm was operating as a perfectly competitive firm, what level of output would they produce to maximize profits?

If the firm was operating as a perfectly competitive firm, what level of output would they produce to maximize profits?

A. Somewhere greater than Qc B. Qc C. Qo D. Somewhere between Qc and Qo

Monopolistic competition is a market structure in which there

a. are no good substitutes produced within the industry, giving each firm substantial market share b. are perfect substitutes produced within the industries, giving each firm only partial market share c. are monopolies competing to create monopolistic competition in the short run and oligopoly in the long run d. are a large number of substitute goods produced in the industry e. are only a few firms in the industry

Which of the following is a treaty to eliminate all trade barriers between Canada, Mexico, and the United States?

(A) MERCOSUR (B) NAFTA (C) CARICOM (D) APEC

Table 5.1National Income Accounts (dollar figures are in billions)Expenditures for consumer goods and services$4,565Exports$740Government purchases of goods and services$1,465Social Security taxes$510Net investment$225Indirect business taxes$520Imports$825Gross investment$865Corporate income taxes$185Personal income taxes$750Corporate retained earnings$45Net foreign factor income$20Government transfer payments to households$690Net interest payments to households$0On the basis of Table 5.1, personal saving is

A. $6,445 billion. B. $5,790 billion. C. $5,620 billion. D. $6,530 billion.