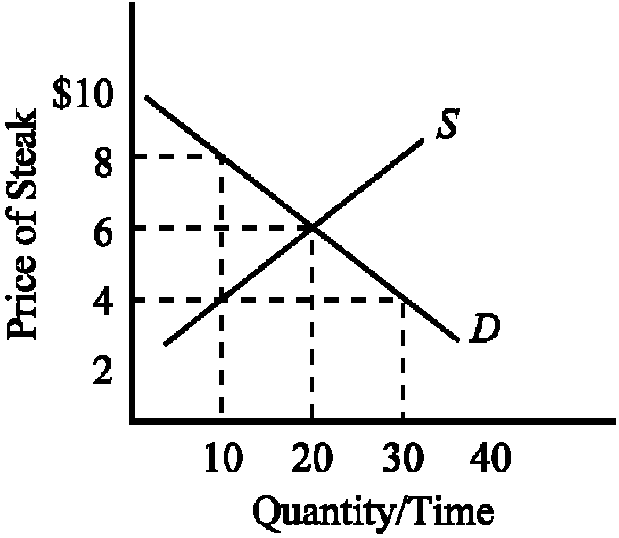

Figure 3-2

Given the supply and demand conditions illustrated in , the equilibrium price of steak is

a.

$2 per pound.

b.

$4 per pound.

c.

$6 per pound.

d.

$8 per pound.

c

You might also like to view...

The owners of the resource ________ are paid ________

A) land; wages B) labor; profit C) capital; rent D) capital; interest E) entrepreneurship; wages

Suppose you are Joe -- one of many souvenir shop owners in a town centered around tourism. All souvenir shop owners face the same decreasing returns to scale production technology as well as recurring annual fixed costs, and they all sell a single local novelty x that is identical across all shops. Assume at the outset of each part below that the souvenir shop market in this town is in long run equilibrium and treat each part separately - i.e. do not carry what you concluded in one part into the next - except for part (e) where you are explicitly asked to continue with the set-up in part (d).

a. The Disney Corporation has set up a new theme park in a town 20 miles away and, as a result, a fraction of tourists that used to stay in your town are now staying elsewhere on their vacation. What happens to your price and output in the market and in Joe's business in the short and long run (assuming that you remain open for business)? Can you tell whether the number of souvenir shops in your town increases or decreases?b. A new mayor in your town lowers recurring annual business license fees. What happens to the price and output in the market and Joe's business in the short and long run? Will the number of souvenir shops in the town increase or decrease?c. A local reporter discovers that the famous "Joe the Plummer" is a distant cousin of yours - and you convince your cousin Joe to join you in your business. The newly renamed souvenir shop, "Joe and Joe", is featured on national television after a visit by "Joe the Vice-President", and you decide to stamp "Greetings from Joe, Joe & Joe" on all of your merchandise. As a result, tourists are willing to pay $y more for your x than they would be willing to pay at any non-Joe store where x does not contain the coveted "Greetings from Joe, Joe & Joe" stamp. How does your output change in the short and long run (assuming capital is fixed in the short run but not in the long run and assuming it costs nothing to put the stamp on your products)?d. Suppose this town is located on the beach in North Carolina where there is a "high season" during the 6 warm months of the year and a "low season" during the 6 cool months of the year. Demand is high during the high season and low during the low season. On two recent visits to this town - one in the summer and one in the winter -- I noticed that prices for x where considerably higher during the high season. Explain how two different prices in different seasons could exist in an industry that is in long run equilibrium. Use side-by-side graphs of the market and Joe's business in your explanation, illustrating both the high demand DH and the low demand DL in the market. How do these different prices relate to the lowest point of the long run AC curve at Joe's business?e. Suppose that I noticed one other thing on my recent two visits to this town: only half the souvenir shops are open in the winter while all are open in the summer. Is this compatible with our assumption that souvenir shops face decreasing returns to scale throughout (and no short run fixed costs)? (Hint: Think about what must be true for half the shops to close for 6 months - and what this implies for short run cost curves and shut down prices.) What will be an ideal response?

Under a fixed exchange rate regime, if a country has an ________ exchange rate, then its central bank's attempt to keep its currency from appreciating will result in a ________ of international reserves

A) undervalued; gain B) undervalued; loss C) overvalued; gain D) overvalued; loss

Fiscal restraint is defined as

A. Tax cuts or spending hikes intended to reduce aggregate demand. B. Tax cuts or spending hikes intended to increase aggregate demand. C. Tax hikes or spending cuts intended to reduce aggregate demand. D. Tax hikes or spending cuts intended to increase aggregate demand.