Jack recently took out a loan from Diane at an interest rate of 5 percent. Diane expected this year's inflation rate to be 2 percent and the real interest rate to be 3 percent. The loan is due at the end of this year. Complete the table below by computing the real interest rate for each possible inflation rate. For each situation, determine whether the unexpected inflation level benefits Jack or Diane.

What will be an ideal response?

4

1

5

7

d

j

d

d

You might also like to view...

The Board of Governors of the Federal Reserve System is

A) elected by the public. B) elected by members of the American Banking Association. C) appointed by the Congress. D) appointed by the President with approval of the U.S. Senate.

The multiplier is 5 and, as a result of a change in expenditure, equilibrium expenditure and real GDP change by $200 billion. What was the initial change in autonomous expenditure?

A) $20 billion B) $50 billion C) $1,000 billion D) $40 billion E) $200 billion

Advocates of real business cycle theories argue that all of the following could cause a recession except

a. a fall in consumer expectations. b. natural disasters. c. higher taxation. d. increases in the price of oil.

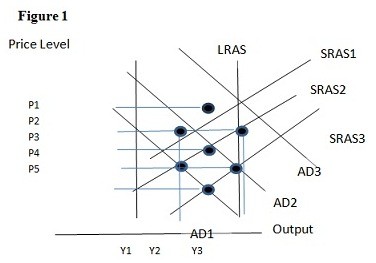

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.