Assume that the central bank lowers the discount to increase the nation's monetary base. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to the quantity of real loanable funds and monetary base in the context of the Three-Sector-Model? State your answer after the macroeconomic system returns to complete equilibrium

a. The quantity of real loanable funds rises and monetary base rises.

b. The quantity of real loanable funds rises and monetary base falls.

c. The quantity of real loanable funds and monetary base fall.

d. The quantity of real loanable funds and monetary base remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.D

You might also like to view...

In the life-cycle hypothesis, people are assumed to have a consumption pattern that leads them to dissave

A) at no point in their life. B) in the working years up to retirement. C) in their retirement years. D) in every year of their life.

The Phillips curve model suggests that a negative demand shock will raise unemployment and reduce inflation. A negative supply shock will have the same effect.

Answer the following statement true (T) or false (F)

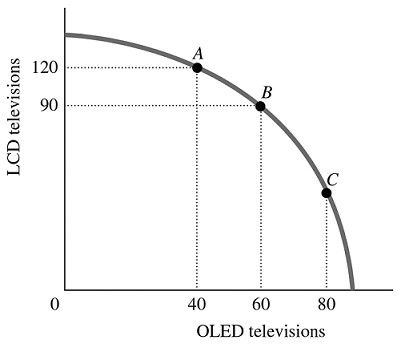

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point B to Point A is

Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point B to Point A is

A. -2/3. B. -3/4. C. -1.5. D. -20.

Evaluate the validity of the argument that a new industry in a nation needs protection from foreign competition if it is to prosper.

What will be an ideal response?