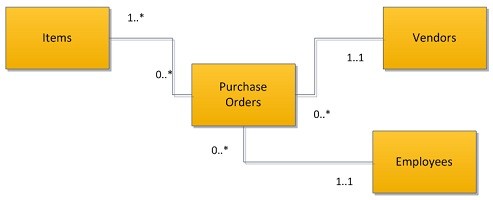

The following UML class diagram should result in how many tables in the relational database?

A. 5

B. 6

C. 7

D. 4

Answer: A

You might also like to view...

Identify the arguments that have not been used to support or refute the ethical legitimacy of preferential hiring policies.

A. Such policies should be rejected because they may create more discrimination as a backlash against gender or racial preferences. B. Preferential hiring is a means of providing more role models for young women and people of color. C. These policies violate the rights of white males. D. These policies are obligatory means for compensating people for harms they have suffered. E. All of the answers are correct. F. None of the answers are correct.

Briefly describe the roles in the buying center

What will be an ideal response?

DRP is used by companies to ______.

a. systematically plan and control their logistics and product distribution activities b. manage inventory levels of finished products at distribution centers c. ensure continuous improvement of the production process d. integrate data across all functional areas

Decelle Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $260,000 and annual incremental cash operating expenses would be $210,000. The project would also require an immediate investment in working capital of $20,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $20,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 12%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The net

present value of the entire project is closest to:See separate Exhibit 13B-1, to determine the appropriate discount factor(s) using the tables provided. A. $27,310 B. $70,000 C. $50,380 D. $14,590