How is the U.S. federal income tax structured?

A. The rate at which income is taxed decreases as income increases

B. The rate at which is taxed increases as income increases.

C. All taxpayers pay the same tax rate.

A. The rate at which income is taxed decreases as income increases

You might also like to view...

When price is below the equilibrium level, there is a shortage of the commodity being sold.

Answer the following statement true (T) or false (F)

Marginal cost is equal to

A) the total cost of a firm's production. B) total cost minus fixed cost. C) a cost that is not related to the quantity produced. D) the change in total cost that results from a one-unit increase in output. E) the change in fixed cost that results from a one-unit increase in output.

Any production point outside the production possibilities frontier is

A) unattainable. B) associated with unused resources. C) attainable only if prices fall. D) attainable only if prices rise.

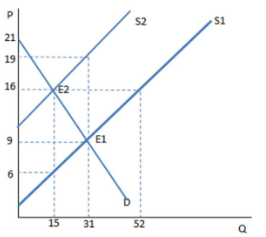

The graph shown demonstrates a tax on sellers. Which of the following can be said about the effect of this tax?

The graph shown demonstrates a tax on sellers. Which of the following can be said about the A. The tax creates a shortage, and rationing must occur.

B. The tax creates a surplus, and the government must buy the excess.

C. The tax creates a shortage, and the government must regulate the market.

D. None of these is true.