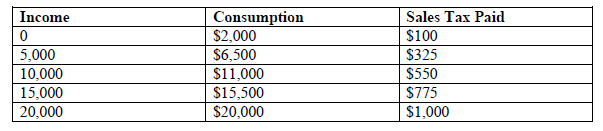

The marginal rate of consumption taxation (with respect to increased consumption) in the table is

a. 4.0 percent.

b. 4.5 percent.

c. 5.0 percent.

d. 5.5 percent.

c. 5.0 percent.

You might also like to view...

When testing for differences between the means of two related populations, either a one-tailed or two-tailed test can be used

Indicate whether the statement is true or false

The following events apply to Bowman's Cleaning Service for Year 1.1) Issued stock for $44,000 cash.2) On May 1, paid $27,000 for one year's rent in advance.3) Purchased on account $4,500 of supplies to be used in the business.4) Performed services of $68,400 and received cash.5) At December 31, adjusted the records for the expired rent.6) At December 31, an inventory of supplies showed that $660 of supplies were still unused.Required: Draw an accounting equation and record the effects of the above events under the appropriate account headings. Show the year-end total for each account. Precede the amount with a minus sign if the transaction reduces that section of the equation. Enter 0 for items not affected.

What will be an ideal response?

If a taxpayer does not own a home but rents an apartment, the office in the home deduction is not available

a. True b. False Indicate whether the statement is true or false

What percentage of medical insurance payments can self-employed taxpayers deduct for adjusted gross income on their 2018 tax returns, assuming their self-employment income exceeds their medical insurance payments?

A. 60 percent B. 70 percent C. 50 percent D. 90 percent E. 100 percent