In contrast to changes in government spending, tax changes affect spending

a. directly.

b. in the same proportion.

c. by a greater amount.

d. indirectly.

d

You might also like to view...

Homelessness is not caused by _____

a. the high cost of housing in cities b. the deinstitutionalization of the mentally ill c. drug abuse d. housing subsidies

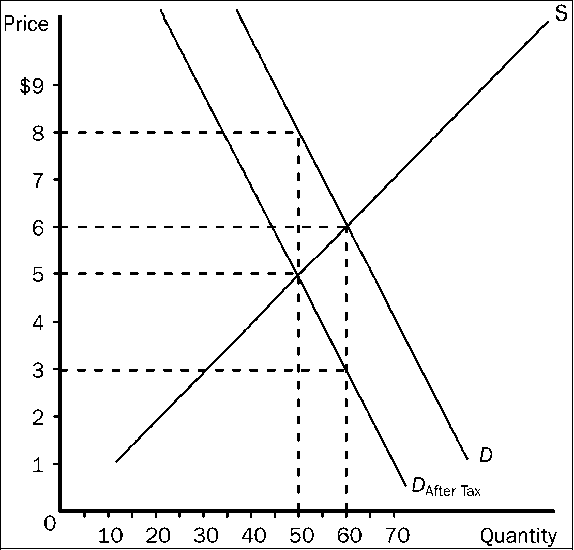

Figure 4-20

Refer to . Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. Now, relative to the case depicted in the figure,

a.

the burden on buyers will be larger and the burden on sellers will be smaller.

b.

the burden on buyers will be smaller and the burden on sellers will be larger.

c.

the burden on buyers will be the same and the burden on sellers will be the same.

d.

The relative burdens in the two cases cannot be determined without further information.

Suppose that you're the manager of a firm. You notice that when you raised your price from $10 to $11, sales fell from 500 to 400. Should you raise your price more?

What will be an ideal response?

When some firms exit a monopolistic competitive industry, the demand curves of the remaining firms in the industry

A. shift to the right. B. shift to the left. C. do not change. D. shift downward.