Which one of the following is not an accurate statement regarding the direct write-off method of accounting for bad debts?

a. The direct write-off method has some deficiencies when accounting for bad debts.

b. The direct write-off method ignores the possibility that partial collection of a company's outstanding accounts receivable may occur.

c. Under the direct write-off method, an expense is increased.

d. The allowance method for bad debts violates the matching principle, but the direct write-off method does not.

d

You might also like to view...

In CMM theory, our greatest moments of mutual understanding, happiness, and fulfillment in interpersonal communication are referred to as ______.

a. awakenings b. peak communication experiences c. meaningful moments d. comprehension elevations

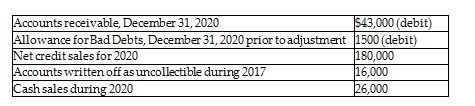

The following information is from the 2020 records of R & S Commercial Plumbing Company:

Bad debts expense is estimated by the percent-of-sales method. Management estimates that 6% of net credit sales will be uncollectible. Calculate the amount of bad debts expense for 2020.

A) $10,800

B) $8220

C) $12,360

D) $9300

U.S. citizens, resident aliens, and domestic corporations are taxed by the U.S. government on their worldwide income at regular U.S. tax rates.

Answer the following statement true (T) or false (F)

According to the Keown book, the average student debt is more than ________. In addition, according to a recent Fidelity survey, total student debt-including credit card debt and personal and family loans-tops ________.

a. $9,000; $15,000 b. $19,000; $25,000 c. $29,000; $35,000 d. $39,000; $45,000