Firefighters are highly skilled workers who are typically employed by city governments. If a city reduces the wage rate paid to firefighters to be less than the equilibrium wage rate, what happens to the economic rents earned by the firefighters?

A) Increase

B) Decrease

C) Remain unchanged

D) Public employees like firefighters cannot earn economic rents

B

You might also like to view...

Why is the Social Security system in crisis at a time when it's running large surpluses? What's the source of the problem? What solutions have been proposed?

What will be an ideal response?

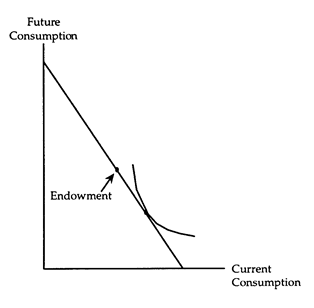

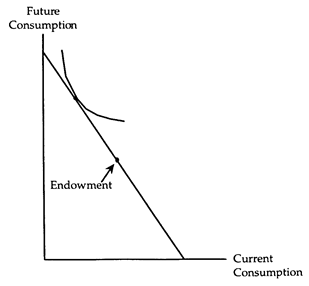

Consider the following:

(i) The accompanying diagram shows a net borrower. Complete the diagram to show how a net borrower is affected by a rise in the interest rate. Is the net borrower better off or worse off? Does the net amount borrowed increase or decrease? Explain, using substitution and income effects.

(ii) The accompanying diagram shows a net lender. Complete the diagram to show how a net lender is affected by a rise in the interest rate. Is the net lender better off or worse off? Does the net amount lent increase or decrease? Explain, using substitution and income effects.

Which of the following is false?

A) Economists who believe that the AS curve is vertical assert that changes in Real GDP originate only on the supply side of the economy. B) Economists who believe that the AS curve is upward-sloping assert that changes in Real GDP originate only on the supply side of the economy. C) For economists who believe that the AS curve is upward-sloping, government policy that aims to impact either side of the economy (supply or demand) will change both prices and Real GDP. D) Compared to the economists who believe that the AS curve is upward-sloping, the economists who believe that the AS curve is upward-sloping assert that the government has fewer tools with which to change Real GDP.

Suppose that a bank has $250 in vault cash, $750 in deposits at the Federal Reserve, $9,000 of loans, and deposits of $10,000. How much does this bank have in reserves?

a) $250 b) $750 c) $1,000 d) $9,000