The simple circular-flow model for households and firms is an economic model that focuses on the interaction between households and firms. Which of the following statements regarding the model is correct?

a.) the model is missing the interaction between firms and the resource market. Therefore, it cannot predict well.

b.) the model is missing the interaction between households and the product market. Therefore, it cannot predict well

c.) the model has too many simplifying assumptions, and it cannot be used to make predictions about the real world

d.) the model is a simplification of the real world, and it can be used to make predictions about the real world

e.) the model is missing the interaction between firms and the produce market. Therefore, it cannot predict well

Answer: d.) the model is a simplification of the real world, and it can be used to make predictions about the real world

You might also like to view...

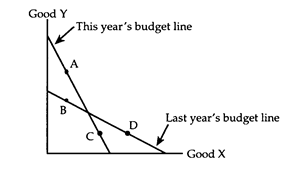

Consider an income tax and a head tax, the sizes of which have been set so that the government collects the same amount of money under each tax. Which tax does the consumer prefer?

a. The consumer is indifferent between the two taxes, since he pays the same amount of money under each tax.

b. The consumer prefers the head tax, because it does not lower the relative wage as does the income tax.

c. The consumer prefers the income tax, because it can be avoided by increasing the amount of leisure time consumed.

d. The consumer may prefer either tax, depending on whether the income tax increases or decreases the number of hours of work at the optimum.

If the economy is in recession, explain what advice you would give the President, if you were a monetarist economist. What if you were a Keynesian?

In nations where the supply of real loanable funds is inelastic, the real risk-free interest rate is likely to:

a. To fluctuate more than the equilibrium quantity of loanable funds per period. b. Be very stable over time and not to react strongly on changes in demand. c. Be high compared to countries where the supply of real loanable funds is elastic. d. None of the above.

If the market price falls below the bottom of the firm's ATC curve:

A. the market price must be lower than the firm's AVC. B. Total revenue must be higher than total cost. C. there is no level of output at which the firm can make a profit. D. the firm is earning profits.