Personal income taxes and corporate income taxes are examples of ____ taxes.

A. variable

B. sales

C. fixed

D. disposable

Answer: A

You might also like to view...

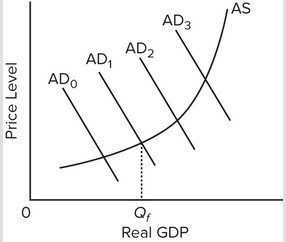

Use the following graph to answer the next question. In the diagram, Qf is the full-employment output. An expansionary fiscal policy would be most appropriate and needed if the economy's present aggregate demand curve were at

In the diagram, Qf is the full-employment output. An expansionary fiscal policy would be most appropriate and needed if the economy's present aggregate demand curve were at

A. AD0. B. AD1. C. AD2. D. AD3.

Other things being equal, the effects of an increase in the price of computers would best be represented by which of the following?

a. A movement up along the demand curve for computers. b. A movement down along the demand curve for computers. c. A leftward shift in the demand curve for computers. d. A rightward shift in the demand curve for computers.

When the 2010 Patient Protection and Affordable Care Act is fully implemented, it will

a. set the prices (reimbursement rates) for more than 7,000 . different medical procedures. b. increase the supply of doctors and other medical services. c. increase the supply of doctors and other medical services. d. reduce the share of health care expenses paid for by a third party, which will increase the incentive of both consumers and medical providers to economize. e. All of the above are true.

Suppose that Elmer's hourly wage increases, and he decides to work fewer hours. For Elmer, the substitution effect of the wage change is

a. only partially offset by the income effect. b. more than offset by the income effect. c. exactly offset by the income effect. d. We do not have enough information with which to answer the question.