A proportional income tax is a tax for which the total amount paid does not increase with income

Indicate whether the statement is true or false

FALSE

You might also like to view...

Fluctuations in aggregate demand and aggregate supply explain why real GDP fluctuates

Indicate whether the statement is true or false

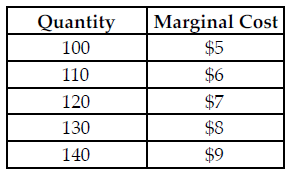

Refer to the table below. The perfectly competitive firm has a random demand with a 50 percent chance of being $5 and a 50 percent chance of being $7. What quantity should the firm produce to maximize its expected profit?

The above table summarizes the marginal cost of production at various quantity levels for a perfectly competitive firm.

A) 110

B) 120

C) 100

D) 130

Environmental damage

a. cannot be reduced to zero. b. is inevitable where humans exist. c. tends to increase as long as benefits outweigh the costs to the damagers. d. All of the above are correct.

In the year 2005, the rate of personal savings in the United States was below _____ percent.

A. 15 B. 10 C. 5 D. 1