With regard to its profits and losses, how is the short run different from the long run for a perfectly competitive firm?

What will be an ideal response?

The firm can make an economic profit, incur an economic loss in the short run, or make zero economic profit in the short run. In the long run, however, the only possible outcome is making zero economic profit. An economic profit attracts entry by new firms and economic losses lead to exit by some firms. Thus, after entry or exit is complete in the long run, the remaining firms will earn zero economic profit.

You might also like to view...

In the figure above, the SLF curve is the supply of loanable funds curve and the PSLF curve is the private supply of loanable funds curve. If there is no Ricardo-Barro effect and the government now runs a balanced budget,

A) the interest rate will increase from 4 percent to 6 percent. B) there is a surplus of investment funds and the interest rate falls to 4 percent. C) there is shortage of investment funds of $0.4 trillion. D) the equilibrium interest rate is 6 percent and investment is $1.6 trillion. E) the equilibrium interest rate is 4 percent and investment is $1.8 trillion.

Property promised to the lender as compensation if the borrower defaults is called

A) collateral. B) deductibles. C) restrictive covenants. D) contingencies.

When a negative externality creates a market failure, that failure can be corrected by

a. setting price equal to private cost b. setting price equal to social cost c. setting price equal to the externality cost d. creating a positive externality of comparable value e. setting private cost equal to social cost

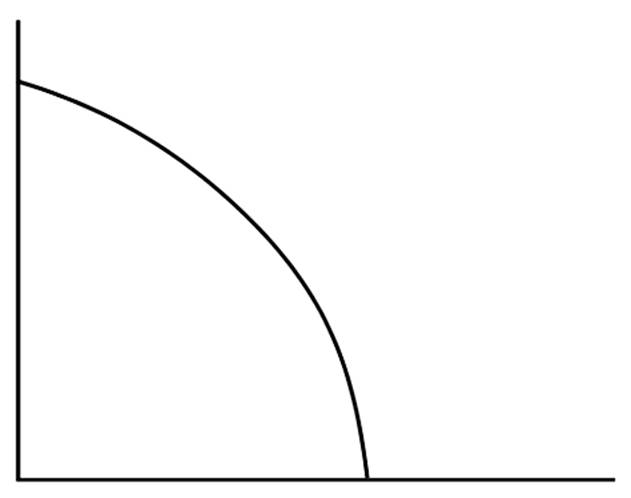

Place point C on the graph to indicate where the United States economy operated in 1997.