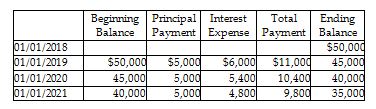

On January 1, 2018, Belview, Inc. issued long-term notes payable for $50,000. The note will be paid over 10 years with payments of $5,000 plus 12% interest due each January 1, beginning January 1, 2019. The amortization schedule for the first three payments is provided.

Prepare the journal entries for the issuance of the note and for the January 1, 2020 note payment. Omit explanation.

1/1/18 Cash 50,000

Notes Payable 50,000

1/1/20 Notes Payable 5,000

Interest Expense 5,400

Cash 10,400

You might also like to view...

Discuss the advantages of using direct format for negative news messages, and how to develop a strong opening paragraph for this format

What will be an ideal response?

When we use breakeven analysis to find a location for a manufacturing facility, we take into account ______.

A. revenues B. profits C. costs D. production quality

Is electronic communication, such as e-mails and instant messaging, the most ef?cient and productive means of communicating in the workplace?

A) Yes. B) No.

A ________ is a company's acquisition of one of its customers or suppliers

a. vertical merger b. conglomerate merger c. horizontal restraint d. horizontal merger