When we add a personal income tax to the macroeconomic model, the

A. multiplier becomes larger.

B. multiplier becomes smaller.

C. expenditures schedule shifts upward.

D. expenditures schedule becomes steeper.

Answer: B

You might also like to view...

The table above gives the supply schedule for a product. Using the midpoint method, find the price elasticity of supply between points A and B, between B and C, between C and D, and between D and E

What will be an ideal response?

Government purchases are part of _______ and include _______

a. national income; federal and state government purchases b. GDP; federal, state, and local government purchases c. GDP; federal government purchases only d. national income; federal government purchases only e. national income; federal, state, and local government purchases

A positive demand shock causes the aggregate demand curve to undergo an ______ shift.

a. anticipated rightward b. unexpected rightward c. anticipated leftward d. unexpected leftward

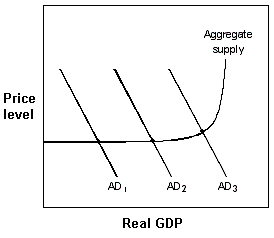

Exhibit 20-4 Aggregate demand and supply model

?

A. raise the legal reserve requirement B. raise the discount rate C. increase the federal funds rate D. buy government securities