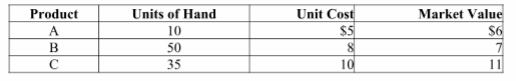

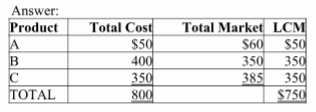

A company had the following ending inventory costs:

Required:

Calculate the lower of cost or market (LCM) value for each individual item.

You might also like to view...

Wikis can be used effectively in an organization with appropriate guidelines, editorial oversight and strong security policies

Indicate whether the statement is true or false.

A C corporation’s disadvantage is double taxation. This means that:

b. the corporation pays taxes in April and October c. corporations are taxed more heavily than other corporate structures d. corporations pay taxes on the goods they purchase to create the product rather than on the profits from the sale of the goods

The ________ is the expiration date of the bond

A) future value B) yield to maturity C) maturity date D) coupon

Eric dies in the current year and has a gross estate valued at $16,500,000. The estate incurs funeral and administrative expenses of $100,000 and also pays off Eric's debts which amount to $250,000. Eric bequeaths $600,000 to his wife. Eric made no taxable transfers during his life. Eric's taxable estate will be

A) $4,970,000. B) $15,550,000. C) $4,370,000. D) $16,500,000.