Current liabilities are obligations of a company that it expects to liquidate within

A) one year.

B) the normal operating cycle.

C) the normal operating cycle or one year, whichever is longer.

D) the normal operating cycle or one year, whichever is shorter.

C

You might also like to view...

Answer the following statements true (T) or false (F)

1.Society’s tendencies to view men as less powerful than women influence our everyday relationships. 2.Milgram’s experiment showed that human beings have the capacity to act destructively without being coerced. 3.We rarely test the balance of power in our relationships. 4.Power is relational. 5.The extent to which we use any of the categories of power to control and influence others reveals our influence preferences.

Positioning can be interpreted as

A) the location in a store where customers can find a product. B) whether a promotional message is political or not. C) where an advertiser is on the waiting list to have its commercials aired. D) consumer perceptions of a product relative to the market. E) the body language salespeople use in personal selling.

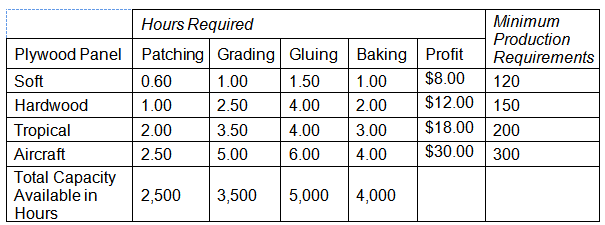

XYZ manufactures four types of plywood panels. Each product must go through the following operations: patching, grading, gluing, and baking. The time requirements for each panel, the capacity available, the minimum production requirements, and the profit contributions per panel are tabled here. Identify the objective function. Let x1 = Number of soft panels to be made, x2 = Number of hardwood panels to be made, x3 = Number of tropical panel to be made, and x4 = Number of aircraft panels to be made.

a. Maximize profits = 8X1 + 12X2 + 18X3 + 30X4

b. Maximize profits = 7X1 + 10X2 + 15X3 + 20X4

c. Minimize costs = 8X1 + 12X2 + 18X3 + 30X4

d. Minimize costs = 7X1 + 10X2 + 15X3 + 20X4

On January 1, 2017, Zing Services issued $168,000 of six-year, 12% bonds when the market interest rate was 11%

The issue price of the bonds was $177,110. Zing uses the effective-interest method to amortize the bond premium. Semiannual interest payments are made on June 30 and December 31 of each year. How much interest expense will be recorded when the first interest payment is made? A) $10,627 B) $9,741 C) $10,080 D) $9,240