Chi transfers assets with a $150,000 FMV (basis $80,000) and $100,000 of business-related liabilities to a corporation in exchange for 100% of the corporation's stock with a FMV of $50,000. The corporation assumes the $100,000 mortgage.

a. What is the amount of gain recognized by Chi?

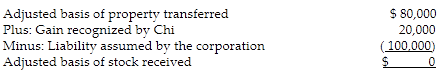

b. What is the adjusted basis of the stock received by Chi?

c. What is the basis of the assets to the corporation?

a.

b.

c. The corporation's basis in the assets is $80,000 (adjusted basis of the property) plus $20,000 (gain recognized by Chi) for a total of $100,000.

You might also like to view...

What are technology transfer agreements? Discuss some of their merits and demerits.

What will be an ideal response?

In the variable costing income statement, which line separates the variable and fixed costs?

a. selling expenses b. general and administrative expense c. product contribution margin d. total contribution margin

Requests for admissions are written requests by one party to another to admit or deny the truth of a statement or thegenuineness of a document

a. True b. False

A business's cash receipts and cash payments for a specific period are reported on a(n) ________

A) income statement B) balance sheet C) statement of cash flows D) cash reconciliation statement