You have just opened a new Italian restaurant in your hometown where there are three other Italian restaurants

Your restaurant is doing a brisk business and you attribute your success to your distinctive northern Italian cuisine using locally grown organic produce. What is likely to happen to your business in the long run?

A) If your success continues, you will be likely to establish a franchise and expand your market size.

B) Your competitors are likely to change their menus to make their products more similar to yours.

C) If you continue to maintain consistent quality, you will be able to earn profits indefinitely.

D) Your success will invite others to open competing restaurants and ultimately your profits will be driven to zero.

D

You might also like to view...

Holding other things constant, diminishing marginal productivity happens to:

A. any input, the more the input is hired. B. labor, the more labor is hired, but not to land or capital. C. capital inputs, the more is hired, but not to labor or land. D. all inputs with the exception of land, the more those inputs are hired.

The Bureau of Labor Statistics complies two different types of market baskets, to reflect the spending habits of two different types of people:

a. All Urban Workers (CPI-U) and All Farm Workers (CPI-F) b. All Urban Workers (CPI-U) and Urban Low Wage Workers (CPI-LW) c. All Urban Workers (CPI-U) and Urban Wage Earners and Clerical Workers (CPI-W) d. All Urban Workers (CPI-U) and All Rural Workers (CPI-R) e. All Urban Workers (CPI-U) and Urban Service Workers (CPI-S).

If the real interest rate is 5%, the rate of inflation in the United States is 6%, and the rate of inflation in the United Kingdom is 3%, which of the following statements would NOT be true?

A) The nominal rate of interest in the United States would be greater than the nominal interest rate in the United Kingdom. B) The difference between the U.K. and U.S. interest rates is a function of the difference between their inflation rates. C) The nominal rate of interest in the United States and the United Kingdom would be the same because of purchasing power parity. D) Investors would get a higher return on their money in the United States.

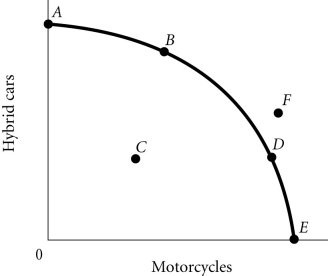

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, an increase in unemployment may be represented by the movement from

Figure 2.4According to Figure 2.4, an increase in unemployment may be represented by the movement from

A. B to A. B. A to C. C. C to D. D. B to D.