Briefly explain put-call parity.

What will be an ideal response?

The relationship between the payoffs of a European call option and the payoffs of an equivalent put option is called put-call parity. In particular, the payoff of owning a European call option and the present value of the exercise price equals the payoff of owning both the underlying stock and an equivalent put option. Since the payoffs of these two positions are the same, the cost to establish these two positions must therefore also be the same. If put-call parity does not hold, then investors have an arbitrage opportunity.

You might also like to view...

Metallic Engineering, Inc., a manufacturer of fabricated aluminum products for aerospace, engineering, automotive, and custom industrial applications, is calculating its WACC. The firm’s common stock just paid a dividend of $1.5 per share and now is selling for $30. The firm’s financial staff estimates the company’s new product will generate an unusual high dividend growth rate of 17% for four years. After this period of time, the dividend growth rate will decline to 3% during a transition period of 3 years, rather than instantaneously. The firm’s debt-to-equity ratio is 3/4 and the flotation costs for new equity will be 7%. Also, the firm has a payout ratio of 60% and 20M of common shares of stock outstanding.

a) Based on the information above, determine the firm’s estimated retained earnings and the associated break-point.

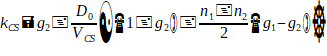

b) Calculate the firm’s cost of retained earnings and the cost of new common equity. Hint: use the required rate of return kCS derived from the H-Model formula in Chapter 9 as follows:

c) If Metallic Engineering’s after-tax cost of debt is 5%, determine the WACC with retained earnings and new common equity.

When introducing people of different rank, proper etiquette is to

A) introduce both by first name only. B) state the name of the youngest first. C) state the name of the person of lower rank first. D) state the name of the person of higher rank first.

Contract damages that put the injured party in as good a position as if the other party had performed are:

a. compensatory damages. b. incidental damages. c. consequential damages. d. liquidated damages.

Which of the following is a form of physical withdrawal?

A. daydreaming B. socializing C. cyberloafing D. tardiness E. moonlighting